Concerns about global warming and the associated problems of climate change, sea level rise, and ocean acidification lead to

- conclusion that we must stop burning fossil fuels and producing CO2 that goes into the atmosphere (where it functions as a greenhouse gas) and into the oceans (where it lowers pH), and to

- proposals on how to conserve energy and transition to non-fossil energies (eg sun, wind, nuclear) that will produce electricity, that will increase the loads on the system for distributing electricity (aka “the grid”), and add to the complexity of the flows of electricity on the grid, and to

- recognition that, for all this to work, the grid must be resilient and reliable, and to

- the analysis below.

A concern about the resilience and reliability of the electric grid managed and maintained by JCP&L in my central NJ town also prompts this analysis.

Bill Allen 10-22-20

Background

Petition and Decision: JCP&L is a subsidiary of First Energy Corp and serves 1.1 million electricity customers in north and central NJ.

On July 13, 2018 it filed a petition with NJ BPU (Board of Public Utilities) to “accelerate electric distribution infrastructure investment to meet expected future storm-related and blue-sky challenges as well as to enhance long-term distribution system safety, reliability, and resiliency and support economic growth in New Jersey.” The program was called Reliability Plus and the proposed investment was $386.8M (millions of dollars), to be made over four years, 2019 to 2022. (Ref A)

Note 1: Links to references and another note are at the bottom of this page.

On December 19, 2017, BPU established a regulatory mechanism supporting Infrastructure Investment and Recovery (II&R) programs, which allows a utility to “accelerate its investment in the construction, installation, and rehabilitation of certain non-revenue producing utility plant and facilities.” The ll&R rules allow the utility more rapid recovery of qualifying incremental investments, if its program satisfies certain criteria. JCP&L’s petition argued that its Reliability Plus program would satisfy these criteria.

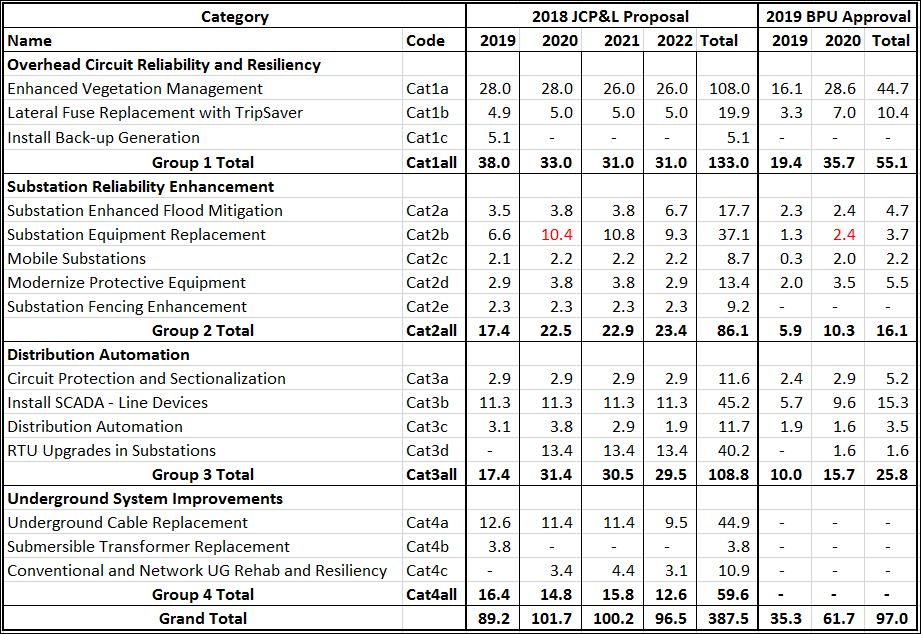

On May 8, 2019 BPU adopted a resolution in which it approved investment of only $97.0M in less than two years, the remainder of 2019 and 2020. (Ref B). Expenditures in the petition and in the resolution were divided into four category groups and fifteen categories. I assigned codes to them for reference. The requested and approved investment amounts are in the table below.

Table 1: Investment Amounts in Millions of Dollars

See Note 2.

These numbers prompt two questions: Why did BPU limit the proposed 4-year plan to less than two years, and why did it reduce the amount in the one full year of 2020 by 40%: from $101.7M to $61.7M? I have not found in the record full answers to these questions.

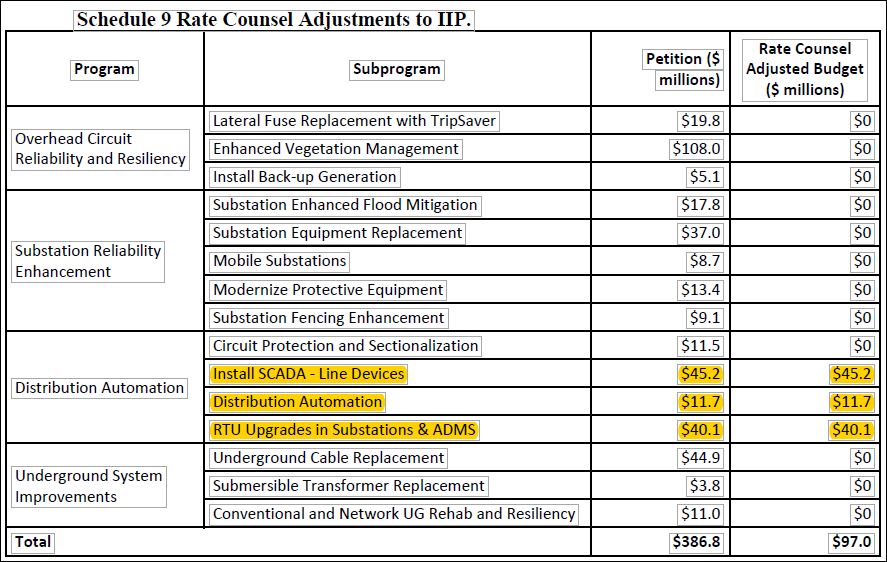

Rate Counsel: The NJ Div of Rate Counsel represents consumers and submits testimony to BPU when utility rates are an issue. It submitted testimony from four consultants in this case. Relevant testimony for our purposes is in Ref C. The consultant rejected most of JCP&L’s proposed spending for work and equipment for two main reasons. (1) The proposed spending was for work and equipment that should be charged to routine maintenance of the system, and did not qualify for the “accelerated cost recovery mechanism” in II&R rules. (2) JCP&L did not provide persuasive benefit/cost analyses.

Table 2 below shows Rate Counsel recommendations.

Observations and Questions for BPU

Overhead Circuit Reliability and Resiliency: This is Category Group 1 in Table 1. Rate Counsel recommended zero for these investments in Table 2, and argued that they are part of regular maintenance and do not satisfy II&R criteria for accelerated cost recovery.

BPU actually approved 6% more than JCP&L requested for 2020, $35.1M and $33.0M, respectively. This should result in less risk and damage to overhead power lines from wind, snow, and ice. Something that is most welcome. We should thank JCP&L and BPU for this increased attention to our overhead lines.

Substation Reliability Enhancement: This is Category Group 2 in Table 1. Rate Counsel recommended zero for enhancements, because they did not satisfy II&R criteria for accelerated cost recovery. However, it did not recommend that the work not be done.

More significant is fact that BPU approved only $10.3M for this in 2020, a reduction of 54% from JCP&L’s proposal for that year. Is BPU saying that only half of the work should be done? Or that all of the work should be done, but only half of it satisfies II&R criteria for accelerated cost recovery?

Question 1 for BPU: Do you intend that JCP&L do only half of the work, that the company has proposed to do? And if so, why?

Distribution Automation: This is JCP&L’s Category Group 3 in Table 1. The recommended investments highlighted in Table 2 above are the 4-year totals for three of the categories in this group: Cat3b, Cat3c, and Cat3d in Table 1. These are the only investment categories where Rate Counsel supported JCP&L’s proposal.

But BPU disagreed. Table 1 shows that it approved only $12.8M for these three categories in 2020 compared to the proposed $27.6M, a 54% cut. This BPU action is significant. I have found no explanation for it.

JCP&L made these arguments for this investment in its 2018 proposal. From Ref A:

- Page 10: “Projects within the Distribution Automation category will provide intelligent monitoring and control over the distribution system and allow for rapid fault location, isolation and service restoration. These projects will reduce the number of customers affected by outages and shorten the duration of outages.” (emphasis added)

- Page 52: “The ADMS software provides the distribution system operators with a complete view of operational conditions of the system. It will provide immediate resiliency benefits to customers by enabling advanced, real-time analysis and decision-making for the re-routing of power in the event of outages.”

- Page 52: “ADMS also provides the platform for future grid modernization investments,

such as Volt/VAR control, and supports the future integration of power flows from

distributed energy resources into the distribution system.”

I am not qualified to judge these recommendations. But the JCP&L words and the endorsement of Rate Counsel suggest that BPU should explain its decision.

Question 2 for BPU: Why did you approve only 46% of the proposed investment?

Underground System Improvements: This is Category Group 4. Rate Counsel did not endorse these investments, again because they did not satisfy II&R criteria for accelerated cost recovery. BPU did not approve them either. I found no further explanation.

Question 3 for BPU: Why did you not approve any of these improvements?

Itemized Investments / Shopping List / Work Items: These are in an Excel workbook with four worksheets. One sheet has notes that explain the other three. One spreadsheet is the shopping list sorted by category and year, and it has subtotals for both. Another is sorted by the names of the towns that will benefit from the proposed work items.

These spreadsheets allow interaction, but changes will not be saved when a session is ended. The workbook is here: JCP&L Pro_20201016_SubCatYear

Help and Comments Are Welcome: There are still unanswered questions and I may have made mistakes in my analysis. If you can expand on what I have written, or disagree with it, then please let me know. In particular, if you are familiar with electrical distribution equipment and practice, then please look at the proposed investments in the workbook and explain the more significant ones to the rest of us.

Wrapup: JCP&L presented a major proposal to improve reliability. Most of it was rejected by BPU and Rate Counsel. What was approved was for only 2019 and 2020. My hope is that JCP&L is serious about improving reliability, and that it will develop another proposal for later years that will be approved.

Those, who believe we must improve the resilience and reliability of the electrical distribution system, should press JCP&L to develop a new proposal, that is well designed to do what is required, and then press BPU to approve it.

Bill Allen 10-21-20

Ref A: JCP&L_20180713_Reliability Plus petition_wo Shop List Downloaded petition filed by JCP&L with BPU on July 13, 2018. Pages of shopping list removed and data moved to spreadsheet. I have highlighted some sections.

Ref B: BPU and JCP&L_20190508_Infrastructure Investment Program _wo Shop List Downloaded decision by BPU and agreed to by JCP&L on May 8, 2019. Pages of shopping list removed and data moved to spreadsheet. I have highlighted some sections.

Ref C: Chang_20181217_BPU JCP&L Testimony Downloaded testimony of consultant retained by Rate Counsel.

Note 2: Petition and decision contained many pages of shopping lists in text format. I moved these data into spreadsheets for analysis. The numbers in Table 1 are from the spreadsheets. They disagree slightly from those in the petition. Some totals in the table disagree slightly with each other because of rounding.