For many years I have read that the size of the financial sector has been growing relative to the economy as a whole. But I was unprepared for what I saw when I looked at the actual numbers.

The Burea of Economic Analysis in the Department of Commerce publishes reams of economic data. One set of tables labeled 6.16 contains annual data for pretax corporate profits by sector going back to 1929. There is quarterly data for recent years.

The tables start with a simple division of the domestic economy into two groups: financial and non-financial. A note says that the former “consists of finance and insurance and bank and other holding companies.”

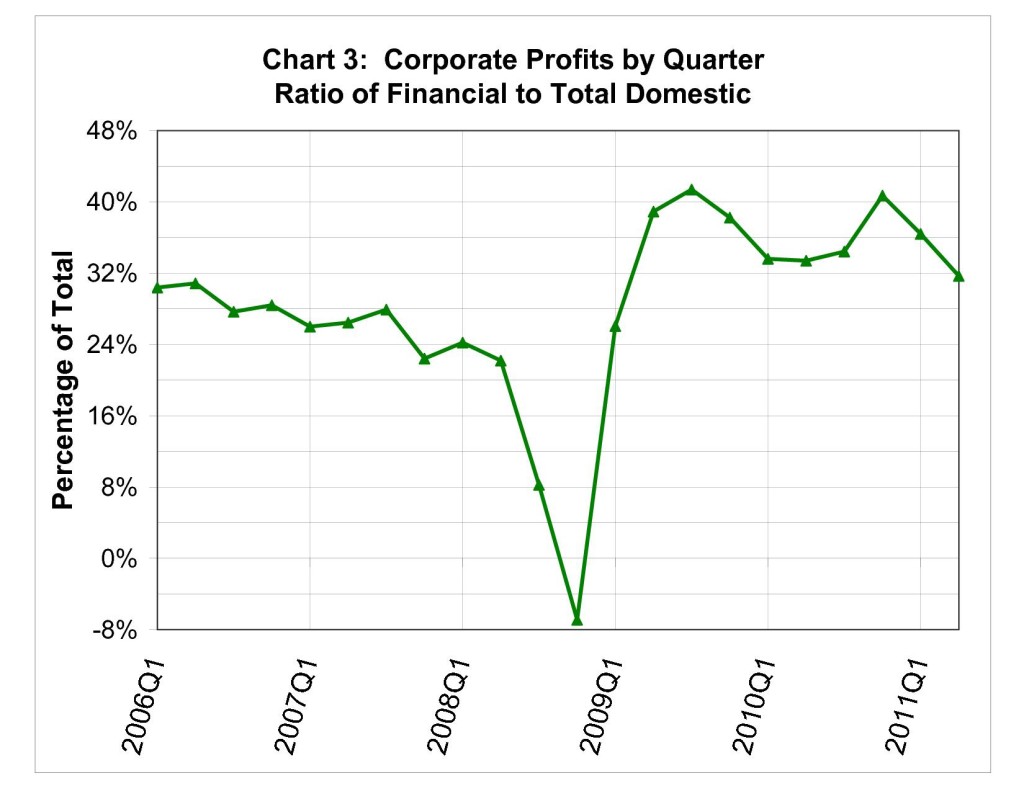

I have summarized this data for the decades following WW2 in Chart 1 below.

In the decade ending in 1960 the financial sector accounted for 12.8% of all domestic corporate profits. Five decades later this had grown by two and a half times to 32.5% of corporate profits. During the decade just past one profit dollar out of three went to the financial sector.

In the decade ending in 1960 the financial sector accounted for 12.8% of all domestic corporate profits. Five decades later this had grown by two and a half times to 32.5% of corporate profits. During the decade just past one profit dollar out of three went to the financial sector.

This growing financial share of the profit pie is remarkable. Those in the Occupy Wall Street demonstrations may not know the precise numbers, but I expect they feel in their gut that the financial share of corporate profits is too large.

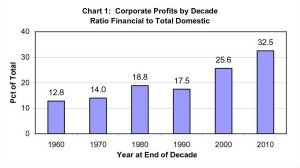

Corporate profits peaked in 2006 and then turned down. Chart 2 shows profits for the finanancial and non-financial sectors, annualized by quarter since 2006.

The financial sector profit hit bottom and turned negative in 2008Q4 [2008 Quarter 4]. This was the “meltdown”. Profit recovered rapidly and topped 2006 levels in 2009 and 2010. It is showing some deline in 2011.

The non-financial sector profit bottomed out in 2009Q2 and recovered less rapidly and went less far. It has not yet climbed back to its 2006 level.

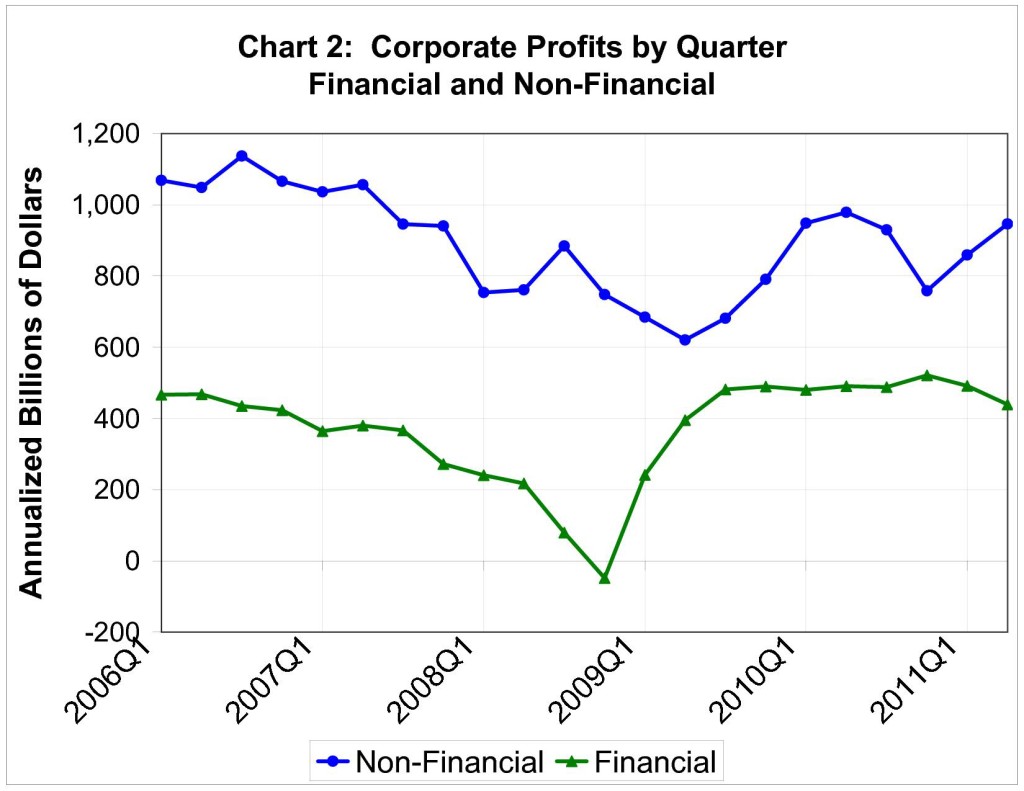

Chart 3 shows the profit share for the financial sector for the same quarters.

These charts show profit shares of the finanical sector marching steadily upwards during the decades after WW2. During the ten recovery quarters from 2009Q1 thru 2011Q2 the profit share ranged from 26.1% to 41.4% and averaged 35.4%. This is higher than the average of 32.5% for the full 2010 decade.

The financial share was down a little in the first two quarters of 2011, but two quarters don’t make a trend.

Bottom line: The financial sector has captured a greater share of domestic corporate profits during five of the last six decades. The trend may be continuing.

Questions for future discussion:

(1) Should taxes be raised on financial profits, or fees be imposed on some financial activites, like short term trades?

(2) Should some financial activities be prohibited, like trading in exotic derivatives that almost no one understands?

Bill Allen, 10-17-11