Main proposal below was completed on 07-11-18 and an introduction was added on 11-23-18.

A formal CFD bill was introduced in the House of Representatives on 11-27-18. It is HR-7173 and named the Energy Innovation and Carbon Dividend Act (EICDA) of 2018. Full text of this bill is here. The rule for allocation of dividends to children in the bill is changed from what CCL has advocated for many years, and that I call Version 1 in post below, to what I call Version 3. Version 1 is no longer relevant. (12-09-18)

HR 763 was introduced in the House in 01-21-19 and is very similar to HR 7173. Full text of new bill is here. Everything written below in 2018 is still applicable, if one ignores Version 1, and understands that Version 3 is the allocation rule that HR 763 contains today. (06-26-20)

Bill Allen

Introduction

The system of carbon fee and dividend (CFD) proposed by the Citizens’ Climate Lobby (CCL) has a revenue side and a dividend side. Comments below deal primarily with the determination and distribution of the carbon fee dividend. They include a proposal to change the rule for allocating dividends to children from what is proposed by CCL today to one that will open a path to a much less complex and costly system for the determination and distribution of all dividends, and produce several other good outcomes. I assume that the reader has some familiarity with CCL and CFD.

Background

I have advocated a carbon tax since the early 90s, promoted a system of carbon fee and dividend since 2010, joined CCL in 2013, helped start the Raritan Valley chapter for NJ District 7 in 2015, and have been active in it.

My introduction to what is now CCL’s rule for allocating carbon dividends to children was in James Hansen’s book Storms of My Grandchildren. I read this in 2010 and concluded that it would be unfair and might create political problems. As a member of CCL I learned that it was proposing this rule, and that implementation would necessitate use of IRS data and a very complicated process for determining household structures. I developed an alternative allocation rule that will simplify the process and resolve the fairness/political issue. I proposed this rule to CCL leadership. It was rejected.

In a presentation for Lobby Days in DC this past June, Allen H. Lerman presented a report in which he described CCL’s proposed system for distributing carbon fee dividends, some variations on that proposal, and another proposal from the Climate Leadership Council (CLC). This report is entitled “Paying Dividends to American Residents from Carbon Fee Revenue” and is linked here as Lerman18.

I did not attend the presentation, but have studied the report. I find much in it that is supportive of what I propose here. And what I propose here will resolve some of the problems that Mr. Lerman identifies.

Mr. Lerman c0-authored with Danny Richter an FAQ report in 2016 that also informs my thinking. Review it at LermanRichter16.

Goal, Strategy, Organization

[1] We need to define our goal. Mine is to gradually reduce burning of fossil fuel in the US to zero in 40 years. 30 would be better. We may never get to zero, but it should be our goal.

I believe CCL is committed to a long-term program, but not to the goal of zero.

[2] The best strategy for today and for the long term is a system of carbon fee and dividend (CFD) with a carbon fee schedule that rises aggressively. We may also need other strategies.

If legislation for CFD is adopted with bipartisan support, and if CFD is introduced smoothly, it is likely to enjoy a honeymoon for a few years. Then opposition will grow.

- As prices rise and start to squeeze, people, who have not adapted because they were unwilling or unable to do so, will push to stop further fee rises or to abolish the program altogether.

- Oil and gas companies, after their coal competition is gone, will oppose higher carbon fees.

We will need strong public support to continue the program. This can come from two sources.

- A steadily rising dividend stream will build a political constituency for CFD.

- People will learn of, and experience more of the problems of climate change and demand strong action.

[3] Determination and distribution of carbon fee dividends will require a new agency, or a new department within an existing agency such as the Social Security Administration (SSA). See Lerman18 on page 22 and LermanRichter16 in Section 19.

Note: A page number cited here is the number for the pdf file, not the one in the report.

I have made the case for a new agency and will assume here that it will be set up, probably inside the Treasury Dept. I call it the Carbon Dividend Administration or CDA. Names are important. “Carbon” reminds us of the challenge, and “dividend” is more friendly than “fee” or “tax”.

CDA will become the public face of the CFD program. Public support for CDA will translate to support for CFD, and dissatisfaction with CDA will reduce support for CFD. It is essential that CDA be competent, efficient, and fair—and that the public sees it that way. I doubt that these standards can be met with the system proposed by CCL today. This concern helps drive the proposal below.

Dividend Share Allocation

[4] The current CCL proposal is to allocate one full dividend share to each adult, one half share to each of first two children in a family or household, and zero shares to later children. A child is defined as a person 18 years old or younger. I call this the Version 1 rule.

I propose that one full share be allocated to each adult, and that all children be treated equally, after accounting for age. Specifically, allocate 1/19th of a share to a child for each year of his or her age thru age 18. I call this the Version 2 rule and first proposed it to CCL in 2016.

The Climate Leadership Council (CLC) was formed in 2017. It proposes to allocate one full share to each adult and one half share to each child. I call this the Version 3 rule and include it in the dividend stream analysis in [11] below.

[5] Administration of the Version 2 rule will begin with transfer of data from SSA to CDA: name, SS number, date of birth, residence address, and bank account if known. There will be a large data dump at the start of the program. After this there will be small and regular transfers of data for new registrants in SSA and for deaths reported to SSA.

With this data and a simple computer program it will be possible to calculate the dividend share allocation for every person in the CDA database for any future date. Call this the “numerical” share allocation to distinguish it from the “monetary” dividend allocation that I describe below in [8].

Key points: A person’s numerical share allocation will depend only on his or her birth date, and this will be in CDA’s database and never change. Its calculation will require no access to or data from IRS. This calculation will be low-cost and essentially error free.

Lerman18 on page 12 recommends that “self-supporting” persons under age 19 and not claimed as dependents be allocated a full dividend share. When identified these persons can be tagged in the database for a full share.

I helped my wife raise two daughters and will state unequivocally that the costs of raising children rise as they grow from toddlers to teenagers. The gradually growing dividend for a child with the Version 2 rule better aligns with family financial needs than does the static half dividend provided with Version 1. More on this below in [11].

The path to CDA and dividends will be thru SSA. A person not registered in SSA, and who is eligible for and wants carbon dividends, should register in SSA in the regular way. Parents of a new baby should register their child in SSA as soon as possible.

[6] Administration of the Version 1 rule will be much more complicated. It will require data on household structures that it will get from IRS. It will have to update this every year, and there will always be some late or inaccurate filings. Some household structures will change during a year. The programming to construct household structures will be complicated. Mr. Lerman addresses several of these issues, identifies potential problems, and suggests remedies in Lerman18.

I believe administration of the Version 1 rule will be expensive and produce errors and delays in dividend distribution. I doubt that it will develop a reputation for competence, efficiency, and fairness—standards that I believe are essential and identified in [3] above.

Dividend Payout

[7] The schedule for carbon fees is very important. The enabling CFD legislation should

- start the fee schedule low,

- raise it rapidly and high enough to achieve the goal,

- adjust it annually for inflation,

- make long term commitment to CFD, at least 20 years,

- provide for periodic and in-depth review of economic and scientific outcomes, say every 4 or 6 years, and

- provide for revision of schedule where appropriate.

Four schedule suggestions follow:

- James Hansen in his 2009 book Storms of My Grandchildren recommends $11.50 per metric ton of CO2 in Year 1 followed by an increment of this amount each year. This seemed reasonable to me and was the basis for my first analysis in 2010.

- CCL now proposes $15 in Year 1 followed by an increment of $10 each year. This also seems reasonable, except that I have never seen an explanation for $15 in Year 1. To be consistent and to keep the starting fee low, I recommend that Year 1 be $10.

- CLC proposes $40 in Year 1 followed by an increment of 2% each year. $40 is much too high to start. It would likely generate public backlash and could jeopardize CFD’s entire future. The 2% rise in later years is too low.

- Economist Alan Blinder in his 2018 book Advice and Dissent recommends $5 in Year 1 followed by an increment of this amount each year. $5 seems too low.

[8] CDA will determine the total fee revenue to be paid out in a payout period. It will add up all the numerical share allocations, and divide this share total into the payout total to get the “monetary” dividend value for a full share. Then multiply this monetary share value by the numerical share allocation for each person to get the monetary value of the dividend for that person.

This will require a simple program that can be run quickly after the payout total is determined for a payout period.

Note: CCL recommends monthly payouts, but there may be situations in which less frequent payouts are appropriate. I use the term “payout period” to cover all situations.

[9] I see four ways to distribute carbon dividends. CDA will send a letter with a Payout Form to every person in its database using regular mail to the address received from SSA, and will ask the person to choose one of four options:

- Receive dividend as check sent via regular mail.

- Have dividend deposited electronically in personal bank or debit card account.

- Have dividend added to the dividend for another person, whom we will call a “bundler.” This person will usually be a parent or guardian. Call this the “bundling” option.

- Have dividend deposited in a government account in the name of the person until the account balance reaches $XX. Then send this amount to the person via regular mail or direct deposit. The account will work like a savings account and earn interest. Call this the “saving” option.

If direct deposit is chosen, the person will provide the account information.

With Version 1, a dividend will be determined for each household; with Version2 it, it will be determined for each person. Mr. Lerman estimates that this would double the dividend payments that would be distributed and states on page 81 of Lerman18 that “separate payment would increase the government’s disbursement costs by a small, but non-trival amount.” The bundling third option will facilitate a single payment to a household that wants this feature, and should alleviate Mr. Lerman’s concern.

If bundling is chosen, the person will enter the name and SS number of the bundler on the Payout Form. The bundler will sign the person’s form. The bundler will indicate a payment option on his or her own Payout Form.

Some people may not have bank or debit card accounts and may not want to cash small checks. The saving fourth option should work for them. They will insert a value for $XX on the Payout Form.

The saving option will also serve persons who want an easy way to save the dividends. They will select it and insert a large value for $XX.

The person will sign and return the Payout Form, and it will be his or her responsibility to keep address and account information uptodate. If the person is a minor, the actions described here will be taken by his or her parent or guardian.

The Payout Form can also include tax withholding instructions.

Dividend Stream

[10] I served four terms on the governing body of my town, a suburban community in central NJ. Property taxes were always a concern. I learned that most people want continuity in taxes—not low this year and higher next year. They authorize government to keep a reserve to buffer fluctuations in revenues and expenses.

I recommend that CDA manage dividend payouts to produce a steadily rising dividend stream—at least for the first 15-20 years before total carbon fee revenue starts to decline. This will build support for CFD. CDA will need a reserve. Mr. Lerman proposes that fee revenue be deposited in a Carbon Fee Trust Fund. This will be CDA’s reserve.

I show in [11] below that Version 2 will help produce a steadily rising dividend stream. That’s one reason for introducing the dividend stream here.

Before the start of a new year CDA will determine the payout total for each payout period. It will consider rising carbon fee schedule, projections of fossil fuel productions in coming year, current administrative costs, payback of one-time startup costs and loan for Year 1 dividends (described below), reserve balance at beginning and end of year, and goal of steadily rising dividend stream.

Using the program described in [5] it will determine the dividend to be paid to each person in each payout period. It will be good public relations for CDA to notify each person of the dividends he or she will receive in the coming year, as SSA does today.

CCL promises to return all carbon fee revenue to members of the public, except for a small administrative expense. (Mr. Lerman estimates this to be 1.1% of revenue in Year 10.) The proposal here is that the timings of the revenue and of the payout be decoupled, in order to produce a steadily rising income stream. All revenue not paid out will be in the reserve, where it can be seen by a skeptic who doubts that we are keeping our promise.

For more re CCL’s position on “contemporaneous payments” and dividend estimation see Lerman18 on page 11.

There will always be a delay between the imposition of a fee on a quantity of fossil fuel at its source and the receipt of the actual fee revenue by CDA. Say this is one year and that the revenue from fees imposed in Year 1 will be paid out in Year 2. I recommend that CDA borrow from the general fund to pay dividends in Year 1, and pay back the loan over next few years.

This is a reason to set the Year 1 carbon fee low and keep the Year 1 loan small.

It will take time for rising prices of fossil fuels to ripple thru the economy and they may not show in some product prices for months or even years. But not gasoline. A fee charge of $10 per ton of CO2 at the well will probably produce an increase of about 9 cents per gallon at the pump very quickly—and very visibly. Dividends should start arriving at the same time. With borrowed Year 1 funds, CDA can make this happen.

[11] I made an analysis last year of the dividend streams for two families with both Version 1 and Version 2 rules for allocating dividends to children.

I have expanded the analysis to include the Version 3 rule. (These rules were defined in [4] above.) In comments below I will abbreviate Version 1 to V1, Version 2 to V2, and Version 3 to V3.

Note: CCL in HR-7173 is now proposing Version 3. See comment in preface to this post.

Below are links to six cases with different family structures. Each is a spreadsheet with three analyses—one for each rule—and a chart that summarizes the results.

Description of spreadsheets:

- Births are separated by 2 years for families with up to 4 children, and by 1 and 2 years for families with 5 and 6 children.

- The birth year for the first child in a family is Year 1 of the CFD program.

- Each analysis is for the period from Year 1 to the first year that all children will have become adults.

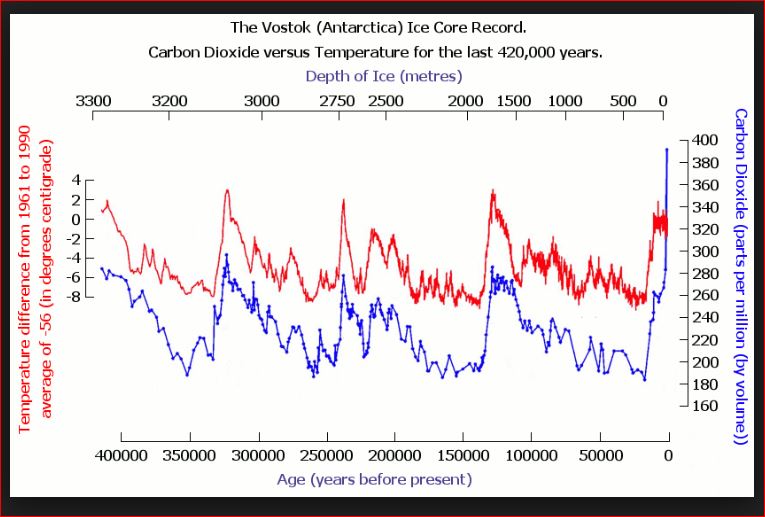

- The share value for a year in Col 2 is based on (a) a revenue model in which the carbon fee rises by $10 per year for 40 years, and CO2 emissions decline linearly from 5 billion tons in Year 0 to zero tons in Year 40, and on (b) an analysis of eligible dividend recipients made in 2010.

- Col 3 thru Col 10 show dividend share quantities for members of the family using V1 rules for the year, Col 11 is the monetary value of all the dividend shares for the year, and Col 12 is the cumulative value thru that year.

- There are comparable sets of ten columns for V2 and V3 rules.

- The chart shows the dividend values for the years.

Click on a case below to see the spreadsheet for that household. The lessons from the analyses make most sense if cases are reviewed from top to bottom.

Case 10 One adult, no children.

- Chart shows trajectory of the value of a full dividend share: first gradual growth, then flattening to peak in Year 19, and start of slow decline.

Case 12 Single parent, two children:

- The chart shows only two lines, because V1 and V3 results are identical and the line for V3 covers that for V1.

- The lines end up at the same place, but the line for V2 is smooth and that for V3/ V1 is crooked. The inflection points for the V3/V1 line occur when a child becomes an adult and moves from a half to a full dividend share.

- The V2 line is a little lower than V1 in the early years and higher in the later years. I commented on this benefit above in [5]. The V2 dividend payouts are better aligned with the financial needs of the family over the childhood years than are V1 and V3.

- Total dividends during the childhood years thru Year 20 are $48,841 for V1 and V3, and $52,332 for V2, a difference of 7.1%.

Case 22 Two parents, two children:

- Same as Case 12, except that there is one more full dividend share allocated for the second parent every year.

- Again total dividends for the childhood years for V2 are greater than for V3/V1. $70,989 and $67,266, a 5.5% difference. Reason: V3/V1 children get a constant half dividend share every year. V2 children get a larger fractional share as they grow older at the same time as the value of a full share is growing. This difference exists in all cases.

Case 23 Two parents, three children:

- V2 and V3 pay a dividend to a third child and V1 does not. The childhood years are thru Year 22, and the cumulative dividends are $$88,322 for V1, $102,198 for V2, and $97,643 for V3. The V3 amount is 10.6% greater than V1, and V2 is 15.7% greater. This shows the unfairness of the V1 rule.

- The V2 dividend peaks in Year 21 and starts to decline, because the value of a full share peaks in Year 19.

Case 24 Two parents, four children:

- The unfairness for a family with more children is more pronounced. The childhood years extend thru 24. The cumulative V3 amount is 18.2% greater than V1, and the V2 amount is 23.0% greater.

- Comparison of the V2 and V3 lines shows greater impact of higher fractional shares for teenagers with V2. This is an argument for V2.

Case 25 Two parents, five children: Trends continue.

Case 26 Two parents, six children: Trends continue.

Conclusions from analyses:

- V1 allocates no dividends to third and later children. V2 and V3 allocate dividends to all children, and resolve the fairness/political issue. This is an argument for V2 and V3 over V1.

- The smooth V2 line will help CDA produce a steadily rising dividend stream. This is an argument for V2 over V3 and V1.

- V2 pays out less than V3 and V1 in the toddler years and more in the teenage years. This is an argument for V2 over V3 and V1.

“Simplification of the Carbon Fee Dividend Payment System”

[12] The section title above appears on page 46 of Lerman18. The report lists five suggestions for simplification. I paraphrase them below in italics and add some comments.

- Provide dividend for all children: This is a feature of both Version 2 and Version 3.

- Increase child dividend from a half share to a full share: A full share allocated to only the first two children would aggravate the fairness problem. If allocated to all children it would invite the charge that CFD is encouraging irresponsible parents to have more children.

- Keep dividend unchanged for whole calendar year: Changing dividends during a year is not a problem for the Version 2 system described in [5] above. The goal of a steadily rising dividend stream may require raising dividends during the year.

- Have annual rather than monthly dividend eligibility determinations: With Version 2 a person’s eligibility does not depend upon his or her relationship to anyone else. Eligibility begins with transfer of data for the person from SSA to CDA. Reasons for termination of eligibility will be rare (eg move to a foreign country).

- Exclude carbon fee dividends from income taxation: I have an opinion on this, but it is not relevant to the principle issue here of carbon dividend allocation.

The inclusion of this section in Mr. Lerman’s report suggests that he believes that the system should be simplified. Version 2 will do that.

Startup

[13] We want CFD to begin right after the enabling legislation is fully approved. But Mr. Lerner makes this sobering comment: “Regardless of the distribution method selected, full implementation would not be immediate. In fact, under the direct payment method full implementation might take two years—or even longer.” (Lerman18, page 14) He is writing about Version 1.

I have no direct experience with internal federal government operations. I did spend 43 years in large, private-sector, manufacturing organizations, the last 20 in operations planning. I participated in the startup of new activities and the expansion of others. Comment below is from that perspective.

After reading about the very complex Version 1 system in Lerman18 and LermanRichter16—with its many potential problems and remedies—and comparing it to the much less complex Version 2 described above, I conclude that two years to implement Version 1 would map to less than one year for Version 1. This is a strong argument for Version 2 over Version 1.

Wrapup

[14] The simple change from the current CCL Version 1 allocation rule to the proposed Version 2 rule opens a path to a much less complex and costly system for the determination and distribution of dividends. It will produce many advantages over what CCL proposes today. A list follows:

- Make system for determination and distribution of dividends fair for all adults and all children.

- Increase dividends for growing families in accord with their financial needs.

- Avoid political mine field of questions regarding “responsible” family size.

- Reduce complexity and cost of system for determining and distributing dividends.

- Remove need to access or use any IRS data.

- Reduce risk of errors.

- Reduce time to start up CFD.

- Make it easy to set up new independent CDA.

- Build trust in dividend distribution system.

- Build long-term public support for CFD program.

Most important: When CDA determines the total fee revenue that it will pay out in a payout period, it can immediately calculate the dividend for each eligible person in its database with a simple program that uses birth date data that is already in the database. There will be no need to get other data from IRS or any other agency.

I strongly urge adoption of the Version 2 allocation rule.

Bill Allen 07-11-18